“THIS painting here, I bought it 10 years ago for $60,000. I could sell it today for $600,000. The illusion has become real, and the more real it becomes, the more desperately they want it.”

Gordon Gecko – Wall Street

Gecko’s most famous quote is obviously “Money Never Sleeps” but the quote picked out above, is very apt for today’s passive income topic. Gordon would have been proud.

You’ve probably seen news reports of record sales for art at the world’s leading auction houses. The current record-holder, at time of writing, is Leonardo da Vinci’s Salvator Mundi, which sold for $400 million in November 2017. While that was a bit of an outlier, it’s perfectly normal for works by well-known artists to sell for millions of dollars. Don’t trash this message just yet! You’re not going to need to produce that much hard cash in order to invest in art. Fortunately, just as music royalties are now more widely available for more realistic amounts of money, there’s also a way that you can own a percentage of a painting.

TL;DR

- Uncorrelated Investment – independent of public markets, so not influenced by the economy or stock exchange

- Yields – art investments often pay far higher returns than dividends or bonds

- Low Entry – you can start with a minimum investment of just $20

- Poor Liquidity – you might struggle to get your investment back in an emergency, though this will hopefully change soon

- High Fees – the fees and commissions on art investments are comparable to a hedge fund

What are Passive Income Apps? How To Invest and Make Money by Investing in Art

Why would you want to part-own a painting? Fine art isn’t like a timeshare – you can’t hang it in your house for a couple of weeks in the middle of winter before it gets passed to the next partial owner, right?. Well, paintings do have one thing in common with timeshare properties, which is that they steadily increase in value with every passing moment. Each year that goes by, historic works get another year more historical and, in some cases, a considerable percentage more valuable.

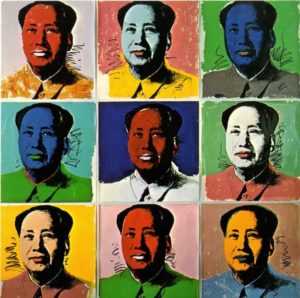

Let’s look at some examples. David Hockney’s Day Pool with Three Blues (Paper Pool 7) was painted in 1978 and sold for about $10.5 million in May 2019. It had been bought in 2000 for just $665,750. One version of Andy Warhol’s Mao series was bought for $24,200 and sold 28 years later for over 36 times that amount – $874,000. Another was bought for $1.03 million and sold for over $47.5 million, increasing in value by nearly 46 times in 19 years.

Frankly, even these increases are relatively small. One work by Claude Monet increased in value nearly 146 times across a 46-year span while an example of Jean-Michel Basquiat’s work went from a five-figure purchase price to a nine-figure sale price, increasing in value more than 5,286 times in 33 years.

Again, it’s worth bearing in mind that these are relative outliers – noteworthy works by renowned artists. For every Pollock, Picasso and Pontormo, there are dozens of obscure names whose works attract little interest. While Monet and Manet will make money, they are the exception rather than the rule. The key is knowing where to invest to achieve a good return. Or, better yet, knowing someone who knows.

Enter Masterworks, a community of investors who trade in blue-chip art just as they would trade in stocks and shares. It’s all about knowing your art, knowing the market, buying low and selling high. And the returns can be astounding.

How To Start Investing in Art

Masterworks is a relatively simple platform and entirely businesslike:

- Masterworks buys a painting with their own money.

- They file the paperwork with the Securities and Exchange Commission to allow them to offer shares in that work publicly.

- They invite members of their community to buy these shares.

- Some years later, once the value of the painting has significantly increased, they sell the painting.

- The profits from the sale are distributed among the shareholders in proportion to their investment.

The decisions of which works to buy and which to avoid are based entirely on data, with a particular focus on ideal works by artists whose art produce demonstrable returns. They look for artists who are globally renowned and in high demand. While a degree of risk is always present, particularly with artists who are still alive and creating works, Masterworks do everything they can to pick paintings that will not be impacted by those risks.

So, how do you personally get started with investing in art? You will need to sign up to Masterworks, which is quite tricky in itself. Being a very exclusive network, the application process requires a phone interview. However, once you’re in, you pick an investment portfolio according to your available capital and the estimate returns. And that’s it. Some years down the line, the painting will be sold again and you will [generally] make a significant income entirely passively.

Install. Register. Done.

In many cases, that’s genuinely all that you need to do. The apps are often free, as are the services they offer. Depending on the app, the registration process might be as simple as putting in an email address or as complex as linking it to a bank account. In all cases, everything is done to make the process as simple as possible.

Things to Consider when Investing in Art

It’s important to note that no investment is completely risk-free. As stated above, Masterworks do what they can to minimise it by choosing the right works by the right artists, but the art world is fickle and trends can shift over time. A painting that was highly-sought after one decade may be maligned the next, leaving your investment effectively worthless.

Furthermore, investment always comes with the inherent hurdle that it requires capital up front. While you won’t need the millions of dollars you might have required to buy the painting yourself, you will still need enough spare cash to buy enough shares to make the investment worthwhile.

And that’s another point – the cash really does have to be “spare”. In order to optimise the earning potential for investors, Masterworks will not sell the paintings they acquire for at least three to five years, though the examples we gave above show that returns are often significantly greater if the gap between purchase and sale is significantly longer. If you urgently need the money you have invested for some other reason, such as a domestic emergency, you’re out of luck – you cannot currently sell your shares, though Masterworks say they are working on adding this option soon.

How Much Does It Cost To Get Started Investing Art?

Masterworks requires that you have a minimum of $1,000 in your account with them, but you don’t have to invest that amount in one go. Instead, the minimum investment is just $20. There is a 1.5% account fee each year and the fee on your investment profit is a whopping 20%.

So, let’s say you set up an account for the absolute minimum amount and make a single $20 investment. Each year, you will spend $15 on your annual account fee and will need to top up your account to keep it open. Assume that your painting is sold after five years, you will have spent $75 on fees. The average annual return on an Andy Warhol painting, according to Masterworks’ website, is 12.17%, so your $20 share should be worth $68.68 after five years. You’ll lose 20% of your $48.68 profit in commission, so you will get your $20 back plus $38.95 – you’ve nearly tripled your investment!

However, take off the $75 in fee and you’ll make an overall loss of $36.05. Suffice it to say, you need to make a lot more than a single $20 investment in order to make a good income.

Learn more about Investing in Art

If you are interested in learning more about Amazon FBA and how it can create you a passive income, check out these links:

Masterworks – Exclusive community of Art Investors

Investor Junkie – Masterworks Review

Making A Mark – Why Art Increases In Value